How to Send Money Home, International Remittance from Japan

"Will I be able to send money home?"

How to send money home as a language student in Japan.

Coming from a Filipino background, it's deeply ingrained in our culture to take care of our families back home once we set foot on foreign soil. This is especially true for OFWs (Overseas Filipino Workers). But, being a student, is this really feasible?

In my previous post, I described in detail how much the initial costs are for studying in Japan. It goes without saying that it gets pretty expensive. I also wrote a post regarding a student's monthly budget to give you an idea of how much you will earn and spend monthly.

As a student, you will be earning an average of 80,000 to 100,000 yen a month for working 28 hours a week, Factoring in tuition, rent, and other necessities, you will probably have about 10,000 left depending on how much effort you put into savings. If you live simply, cook your meals at home, and don't spend much on going out, you can save even more.

There are no hard and fast answers to this question, but technically speaking, yes, you would be able to send money home, but it's not as much as most people expect.

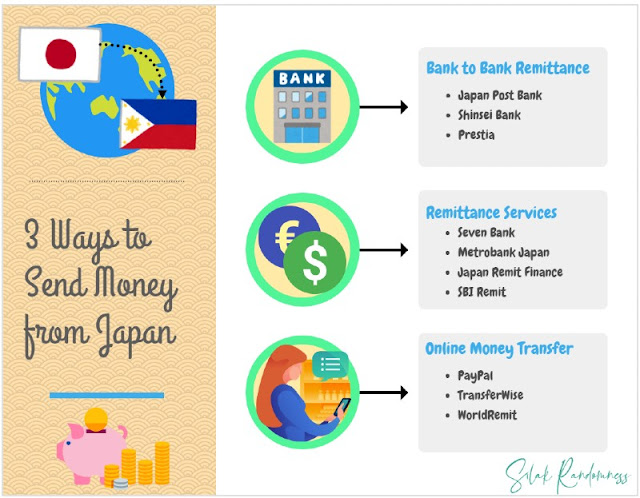

Now that you have established a working budget and will be able to send some money home, let's talk about international remittance in Japan. There are several ways of sending money home including banks, wire transfers, and remittance services.

International Bank Remittance

This is probably the most common and the first thing people think of when you say remittance. Banks are very secure and reliable but they tend to cost more. If you are transferring large amounts of money, going through banks would be the most sensible course but if you are only transferring small amounts (anywhere from 1,000 yen to about 100,000 yen), you might want to go a different route.

Transaction Fees: 4,000 to about 7,000

The best banks to use for international remittance are Japan Post Bank, Shinsei Bank, and Prestia.

Japan Post Bank

You can apply for remittance by filling up an information sheet, printing it out, and bringing it to the nearest Japan Post Bank branch. They have recently suspended their corporate remittance and will only process individual or personal remittances. They charge ¥7500 for over the counter transactions and ¥3000 for online transactions. I haven't tried this yet but I will try and write a post on how to register for their online services.

Shinsei Bank

Shinsei Bank offers bilingual support which is very beneficial to non-Japanese speakers. They also have a smartphone application available making it very convenient. Their remittance fee is a total of ¥4000 yen and may go up depending on how much you will be remitting.

Prestia (SMBC)

Prestia is another great bank for transfers because of its English language support. They also offer mobile and online banking which makes remittance convenient. They charge ¥3500 yen for the remittance and will charge additional fees depending on the amounts.

Remittance Services

Whereas banks are the first thing that pops into someone's mind when sending money home, more and more remittance service centers are stepping up to the plate.

These remittance service centers tend to charge less than banks for transactions and with fees depending on how much you send. Remittance centers would be the best choice for transactions below ¥300,000.

Most remittance services offer to give you a furikomi card for easy sending and recipients at home can choose whether to pick up the money or have them deposited to a bank account.

Seven Bank

Seven Bank gained popularity because of their mobile app that lets you transfer from your smartphone. They offer discounts if you use their mobile app and guarantees no additional fees to be borne by the receiver. Another feature they offer is the option to receive the transfer in local pick up points all over the Philippines. They also offer directly depositing your remittance to local banks.

Metrobank Japan

This is a local bank in the Philippines that operates a branch in Tokyo and Osaka. They function mainly as a remittance service. I personally chose this because it's convenient for Metrobank account holders. I can transfer money and have it received within a few hours.

Japan Remit Finance

I discovered this remittance recently while researching for this article. It's a reputable remittance service founded in 2011 and by far offers the best exchange rates. These remittance services and banks follow their own exchange rates, and though they post it on their websites, they tend to have different rates. The differences are in decimal points but when you're sending a big amount, the difference grows. I have not tried their service as of writing this, but I did apply for an account with them. If everything goes well, I might be switching over to them soon.

SBI Remit

SBI Remit is another long-standing remittance service established in 2010. They offer competitive fees and exchange rates. I was going to use SBI Remit for my remittances but for reasons I can't remember, I just went with Metrobank. They have a very streamlined registration process and they are very responsive.

Online Money Transfer

For those who have experience working online or shopping online, you have heard of several online payment systems. One classic example is PayPal. I have personally trusted this online payment system for a very long time, and they have never let me down yet. But with the dawn of the digital age, more online money transfer systems are popping up and these are a few that I personally used in the past.

PayPal

I am a fan of PayPal. I learned about PayPal back in the early 2000s when I worked as a chat support agent for eBay. And through the years, they have only improved their security and I have been a member for almost a couple of decades now. To be honest I only ever do online shopping if I can pay using PayPal. As a remittance service, they only charge a currency conversion fee. The catch is, it's a percentage, so the bigger you send, the bigger the fee. Also, they charge you to deposit to your bank account. They charge about 2-3 USD to deposit to bank accounts.

TransferWise

TransferWise is a UK-based online transfer system that I came across in the last 5 years. I made a payment to someone in Thailand using this payment method and the fees were considerably cheaper. A couple of years ago, I couldn't use this account yet because they haven't established their base in Japan yet but I checked recently, they are now fully up and running. I am thinking of trying this service again soon and see which one truly will give me value for money.

WorldRemit

Okay, this one I admit, I have never used. But I did research on it and they function similarly to TransferWise. I did a quick comparison and their conversion rates are very competitive too. This is another way to send money conveniently.

Depending on your needs and level of comfort transacting online, you can choose from these methods to send money back home.

Comments

Post a Comment